Introduction

Perceived Environmental Threats and Support for Environmental Taxation

Political Participation and Its Influence on the Perceived Environmental Threats-Support for Environmental Taxation Linkage

Data and Measurement

Dependent Variable

Independent Variables

Control Variables

Results

Conclusion and Discussion

Introduction

Climate change and environmental pollution have been increasingly posing grave threats to sustainable human life in recent years [1]. Every year, many countries around the world seem to experience an increasing amount of environmental devastation, ranging from severe storms to wildfires. For instance, Australia has been fighting wildfires for over five months, instead of a few days as in the past [2]. Puerto Rico was hit by Hurricane Maria, one of several hurricanes that hit the United States and the vicinity in 2017. The area underwent a shortage of power and food [3]. In January 2020, a powerful storm called Gloria hit Spanish coastal towns with rain and snow, killing dozens of people along the way [4]. The state of California in the United States has had to cope with several devastating wildfires spreading so rapidly that residents did not have time to escape from them [5]. Natural hazards are one issue, but environmental pollution is also menacing the concept of a sustainable environment. By 2025, the oceans may be flooded with so much plastic debris that there could be one pound of plastic for three pounds of fish [6]. The ugly surface of plastic debris stretching for miles in virtually every corner of the world’s oceans presents daunting challenges for governments around the world in their fight for environmental protection and a sustainable environment. To do so, however, governments need a substantial infusion of taxation funds. In this context, citizens’ support for taxation to protect the environment takes on an urgency.

This study, thus, explores what sources are available to increase the public’s willingness for environmental taxation. Specifically, it tackles two major questions: whether individuals’ perception of environmental threats as well as their political participation lead to a positive consequence for environmental taxation and whether individuals’ political participation moderates the relationship between perceived environmental threats and support for environmental taxation and enhances the linkage. Defined as the perceived likelihood of adverse consequences regarding a given environmental event [7], perceived environmental threats have been known to induce pro-environmental behavior [7, 8, 9].

Citizens’ political participation is also a crucial tool to enhance their support for environmental causes. Social capital literature has informed that individuals isolated from political and social life tend to be skeptical toward government policies that can benefit society at large [10]. Environmental protection not only affects the current generation, but also future generations; however, those secluded from others may not see a reason to support such a cause. On the contrary, environmental causes by their very essence require active engagement on the part of citizens. The government, in general, is reluctant to pursue programs that may anger market participants. For instance, the Trump administration in the United States has introduced one deregulatory measure after another [11, 12], which has affected the offshore drilling of oil, pipelines, national monuments, and coal power [13, 14]. To move the government toward a pro-environmental measure such as increasing taxation for environmental protection requires support from citizens who are active in their political and social lives, refuse to purchase products that are detrimental to environmental interests, push for environmental causes in offline rallies as well as online forums, and strive for pro-environmental lifestyles.

A more important question remains as to what mechanism may increase the influence of political participation on the link between perceived environmental threats and support for environmental taxation. The mechanism can be found in social-cognitive theory (SCT); social learning through interacting with others paves the way for one’s own agentic actions to control one’s life [15, 16]. Perceived environmental threats denote an individual’s psychological state regarding the environment [7]. While these perceptions can serve to advance a pro-environmental cause, this alone may not be sufficient to fully activate a person’s desire to make financial sacrifices for environmental protection. Political participation serves as a facilitator to turn passive individuals who may be aware of environmental threats, but do nothing, into those who possess political efficacy and believe that their action will alter a political outcome, such as citizens’ support for environmental taxation.

The study analyzes the 2014 Korean General Social Survey by using ordered probit (n=757) to examine the direct effect of perceived environmental threats on support for environmental taxation and the moderation effect of political participation on the relationship between the two. By examining an understudied political element in pro-environmental behavioral research, this study aims to enrich the mechanisms behind citizens’ support for environmental causes. The study starts with the introduction of relevant theories and proposes research hypotheses. Next, the study subjects those hypotheses to an empirical examination and presents the results along with their implications for both public officials and citizens.

Perceived Environmental Threats and Support for Environmental Taxation

Environmental threats have significantly increased in recent decades [1]. A sizable number of environmental studies highlight that the earth is becoming increasingly warmer with an alarming shrinkage in the size of icebergs. Pollution and resource consumption have also begun to endanger sustainable human life [1]. An unusual amount of environmental devastation foretells menacing environmental threats to humanity. Following these environmental changes, studies on environmental threats and threats perception have intensified in recent decades, as well [7].

Environmental threats perception can be defined as “the perceived likelihood of negative consequences to oneself and society from one specific environmental phenomenon” [7]. In this study, environmental threats are confined to individuals’ perceived likelihood of adverse events resulting from environmental pollution as well as climate change. A central assumption in the environmental threats literature is that individuals who perceive an acute sense of a given threat are more likely to take personal steps to address it or to support governmental actions to ameliorate it [7]. The mechanism connecting perceived environmental threats and ameliorative actions is akin to what terror management theory informs about human social behavior [17]. The theory, based on Becker’s cultural anthropological work (1973), posits that human social behavior centers on the fundamental knowledge of death [9, 17, 18]. That one is aware of one’s own death distinguishes humans from animals; humans’ instincts for self-survival along with a sense of inevitable death lead to humans adopting strategies to fight and prevent sources of terror [9]. This line of thinking can apply to environmental threats. In fact, Langford (2002) qualitatively demonstrated how humans cope with environmental crises to reduce fear and death [19]. When facing significant environmental threats, humans are more likely to experience mortality salience and this will lead them to adopt a pro-environmental measure to reduce it [9, 20]. In short, one’s perceptions of environmental threats entails expectations that the adverse environmental event is threating one’s existence and induces fear of death. This will activate one to search for strategies to buffer the mortality threats. Consequently, those with a significant degree of perception of environmental threats will be more likely to support a pro-environmental behavior such as supporting taxation for environmental protection as in this study.

Studies have shown that threats perceptions relate to ameliorative measures to address an adverse event. For instance, Baldassare and Katz (1992) found that residents sensitive to air and water pollution in Orange County were more likely to take pro-environmental steps such as saving water and buying environmentally safe products [21]. Fisher et al. (1991) found that homeowners with a significant threat of radon in their homes were more likely to take an ameliorative action than those without such threat [22]. Similarly, O’Connor et al. (1999) identified a positive relationship between threats perceptions and willingness to tackle climate change [7]. Liobikienė and Juknys (2016), using a survey targeting Lithuanian residents, showed that individuals with a greater degree of perceived environmental threats were more likely to engage in environmentally friendly behavior [23]. Toma and Mathijs (2007) found that farmers were more likely to participate in organic farming programs when they possessed a higher degree of perceived environmental threats [24]. Finally, Fritsche et al. (2010) found positive relationships between personal threats and pro-environmental behavior [9]. Thus, the following hypothesis is reasonable for an empirical investigation.

Hypothesis 1: Individuals with an increased level of perceived environmental threats are positively associated with support for environmental taxation.

Political Participation and Its Influence on the Perceived Environmental Threats-Support for Environmental Taxation Linkage

Political participation is regarded as a quintessential element in participatory democracy. Defined as “voluntary activities by individual citizens intended to influence either directly or indirectly political choice at various levels of the political system” [25], political participation enables citizens to actively participate in civic and political life [26]. Participatory democracy is predicated on the premise that citizens’ political actions have beneficial effects not only on individuals’, but also on political institutions’ development [26, 27]. Building on classical thinkers, such as Rousseau, theorists on participatory democracy have argued that political participation strengthens individuals’ human character and facilitates their self-actualization [26]. Self-actualization is made possible thanks to individuals feeling a sense of political self-efficacy-a sense that an individual can play a role in effecting a political or social change-through political participation [28]. When one is an active participant in political life, one may come to believe that it is possible to influence the government and political outcomes [29, 30]. Self-efficacy, in turn, enables individuals to secure the necessary skills, self-confidence, and self-competence with which to pursue popular self-government [30]. Individuals who are actively participating in political life are more likely to possess a high degree of political self-efficacy by which they feel confident in influencing politics.

Environmental protection has become a contentious issue in many countries such as the United States [11, 12] and taxation itself tends to provoke visceral reactions from citizens [31]. As such, implementing environmental taxation demands support from citizens who believe that they are capable of initiating a positive change for pro-environmental behavior, such as paying taxation for environmental protection. Historically, for instance, participating in protests and writing petitions have contributed to enacting monumental environmental legislation such as the Clean Air Act in the 1970s for the United States. In Korea, serious discourses about environmental protection were initiated by angry citizens who protested over repeated phenol contamination of the river used for drinking water in the Daegu region [32]. Several studies have also demonstrated that an increased degree of democracy, such as that fostered by citizens’ political participation, is positively associated with environmentalism and sustainability [33, 34]. Therefore, scholars in environmental education have called for more active citizen participation on behalf of environmental causes [34].

The question then arises as to what may explain the mechanism through which political participation can moderate the relationship between perceived environmental threats and support for environmental taxation and amplify such linkage? This study attributes such a mechanism to the social cognitive theory (SCT). This theory is built on the premise that external stimuli or social influences reshape a person and their behavior. The three elements—environment, person, and behavior—reciprocate and reinforce each other. In the process, a person develops self-efficacy (a sense of confidence in performing a behavior) and expectations of what a behavior can entail [35]. The SCT also adopts an agentic perspective [15, 36]. It asserts that being a human means possessing agency, “the capacity to exercise control over the nature and quality of one’s life” [15, 16]. People are not just influenced by environmental factors, but also reshape them through self-efficacy and self-regulation [15, 16]. Experiences gained in performing certain tasks and goals convey and reinforce a sense of meaning and purpose to one’s life [15].

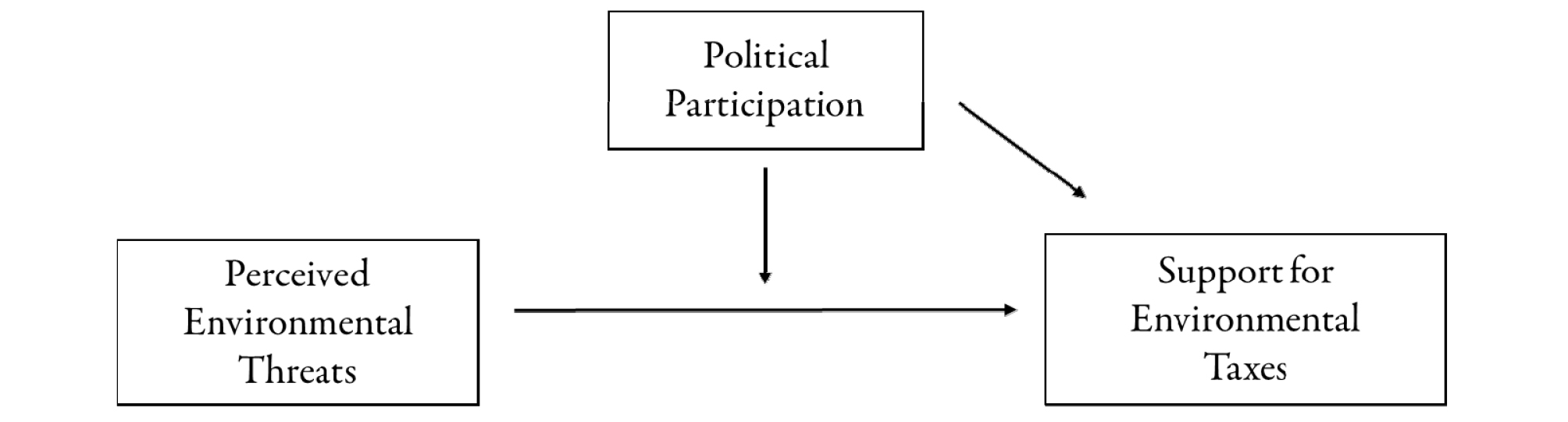

Political participation offers abundant opportunities for social learning and experiences. Watching how others perform in political rallies or online discussion forums, as well as how oneself acts in those circumstances, conveys and reinforces a sense of self-regulation and political self-efficacy in influencing politics for a desirable outcome. Individuals with active political participation are more likely to be agentic in interacting with others, learning from them, and applying the learned experiences to politics for the firm control of their lives. A strong sense of self-efficacy stemming from active political participation [37] will turn perceived environmental threats into doing something tangible and positive to ameliorate them, such as supporting taxation to advance that cause. In this way, political participation will moderate the relationship between perceived environmental threats and support for environmental taxation and serves to enhance the linkage. Thus, the following hypotheses were established for an empirical examination. Figure 1 displays the conceptual framework of the study.

Hypothesis 2: Individuals with a greater level of political participation are positively associated with support for environmental taxation.

Hypothesis 3: Political participation moderates the linkage between perceived environmental threats and support for environmental taxation such that the linkage becomes stronger when the levels of political participation are higher.

Data and Measurement

The study relies on the Korean General Social Survey (KGSS) conducted by the Sungkyunkwan University Survey Research Center. The KGSS was initiated in the mold of its US counterpart, the General Social Survey (GSS), and has been undertaken since 2003. A core group of approximately 140 questions appear in every survey. The KGSS was conducted every year from 2003 to 2014. Since then, the survey has been implemented every two years. The survey uses a multi-stage area probability sampling method and is directed to Korean residents who are 18 years of age or older. Specifically, the study relies on KGSS’ 2014 cross-sectional data, as the main explanatory items are only available for 2014. The study also accounts for a survey weight (provided by the KGSS) that reflects population representation [38]. The sample size for the study is 757.

Dependent Variable

The dependent variable for the study is perceived support for environmental taxes. It relies on a single item: “How willing would you be to pay much higher taxes in order to protect the environment?” The item ranges from 1 to 5, with 5 indicating “very willing” and 1 indicating “very unwilling.” The item goes deeper than simply asking respondents to reveal their environmental spending preferences. Because taxation demands pecuniary sacrifices from citizens, the item accounts for individuals’ willingness to embrace sacrifices for enhancing environmental protection. Although a single item measure is not ideal compared to a multiple-item measure due to limited psychometric properties, some studies have indicated a high correlation between single item measures and multi-item measures [39, 40]. In addition, because the study relies on a secondary dataset, and individuals’ actual behavior is hard to observe, the measure for the dependent variable relies on subjective behavioral intentions. Nevertheless, research evidence points to a close correlation between intentions and actual behavior [41].

Independent Variables

Environmental threats

The measure connotes respondents’ perceptions of environmental threats and consists of six items. Cronbach’s α is 0.984, indicating a high degree of consistency among the items. The measure ranges from 1.67 to 5 and its mean is 3.62, revealing that respondents in general show a high degree of perceptual sensitivity to environmental threats. As hypothesized, it is expected that an increase in the levels of perceived environmental threats would lead to increased support for environmental taxation.

Political participation

Political participation is also a perceived measure indicating how much respondents are willing to engage in political or social activities. The measure comprises four items with Cronbach’s α amounting to 0.951, showing substantial reliability among the items. The items touch upon offline political demonstrations and rallies as well as online forums. The measure ranges from 1 to 4 and the mean is approximately 1.67, indicating that, at least for this dataset, respondents in general are politically passive rather than active. As hypothesized, an increased level of political participation is expected to stimulate the transformation of passive attitudes toward the environment into active attitudes. In doing so, individuals would exhibit greater support for taxes needed to protect the environment. Table 1 shows the descriptive statistics of the variable used.

Table 1. Descriptive statistics

Control Variables

The model also accounts for a slew of control variables. First, the model controls for respondents’ demographic characteristics: age, female, income, and education. Education is included in the model because highly educated individuals are more likely to understand environmental threats posed by pollution and climate change and are more likely to support an ameliorative measure such as supporting an increase in environmental taxation [42]. Females are also more likely to be receptive to environmental concern vis-à-vis males [43, 44] and, consequently, espouse that environmental taxes are necessary to protect the environment. Income may account for support of environmental taxation; individuals with a higher income may want to see a cleaner environment [45] and, as such, support taxation to improve it. On the contrary, individuals with higher incomes may consume more resources [46] and dislike the taxation that environmental protection entails [31]. Thus, income may cut both ways in its influence on supporting environmental taxation.

Two ideology variables are also included in the model. In the United States, in particular, conservatives have been known for fostering the private sector and showing antipathy toward environmentalism [47]. On the other hand, liberals have sided with pro-environmental organizations and have supported environmental causes, such as reducing coal production, developing new renewable energy sources, and reducing carbon footprints [47]. For the ideology variables, liberal and conservative are indicators and moderate serves as the reference variable. Civic mindedness is also needed for pro-environmental behavior; people who feel obligated to uphold civic principles such as making tax payments, monitoring governmental actions, and avoiding unethical products are more likely to exhibit pro-environmental behavior [48]. This item consists of eight items and Cronbach’s α (0.991) shows high reliability among the items.

Political trust is a crucial measure to account for how people behave toward political institutions and governmental actions. Many studies have shown that people with high trust are more likely to support governmental programs or policies than those with low trust [49]. Because people do not possess all the information needed to dissect a government policy, political trust functions as a heuristic by which people tend to judge and support such a policy [49]. Political trust comprises four items, with Cronbach’s equal to 0.809. How people perceive pollution issues in their neighborhood may also influence their support of environmental taxes. Those who feel they have direct experience of such issues are more likely to do something that helps to alleviate them and support environmental taxation [50]. The measure relies on three items and Cronbach’s α is 0.989, demonstrating substantial reliability among the items. The measures comprising multiple items are shown in Table 2 with their reliability. Lastly, the model accounts for respondents’ political interest. Those attuned to the greater political issues of the day are more likely to be cognizant of environmental problems and lend their support to alleviating them [51].

Table 2. Survey items and reliability

As the model includes five variables composed of multiple items, a confirmatory factor analysis was conducted to ascertain whether the model displays a good fit. The five-factor model produces good fit indices: x2(265)=1315.434, RMSEA=0.055, SRMR=0.038, CFI=0.912, and TLI= 0.900. Additionally, Harman’s single factor test shows that no single factor accounts for more than 16.89% of the covariance, indicating that the common method bias—a major cause of concern for relying on a single data source as in this study—may not threaten the validity of the model.

Results

The empirical analysis relies on ordered logit. As the values of the dependent variable are ordinal, ranging from 1 to 5, using a linear method produces biased estimates [52]. Moreover, using a binary logit method for this type of variable may diminish crucial information that the values of the variable contain [53]. Therefore, ordered logit was used to test the three hypotheses.

Table 3 displays the ordered logit results. The analysis contains two models. Model 1 examines direct relationships between independent variables and the dependent variable, whereas Model 2 focuses on the moderation effect of political participation on the linkage between perceived environmental threats and support for environmental taxation. In terms of hypothesis 1, the results confirm that perceived environmental threats are positively associated with support for environmental taxation. Individuals who perceive a greater level of environmental threats are more likely to consider that environmental protection is a worthy cause for paying their taxes. Individuals who perceive themselves as politically active are also more likely to support taxation for environmental protection. More importantly, the study focuses on whether political participation can serve as the moderator and help enhance the positive relationship between perceived environmental threats and support for environmental taxation. The results, once again, confirm that political participation, indeed, serves as the positive moderator and amplifies the positive association between perceived environmental threats and support for environmental taxation. The magnitude of the interaction is quite substantial and surpasses that of the direct effect of perceived environmental threats and political participation on support for environmental taxation.

Table 3. Regression results

In terms of controls, several variables also prove to be significantly associated with the dependent variable. Education positively predicts environmental taxation; those with a greater level of education are more likely to be aware of what is at stake for the environment and be supportive of environmental causes, such as supporting taxation for environmental protection. Income is also a positive predictor of the dependent variable. At least in this dataset, respondents with higher incomes are more receptive to environmental concerns and lend their support for environmental taxation. In addition, several variables are positively associated with the dependent variable. Civic mindedness positively predicts support for environmental taxation [48]; those who conform to civic norms, such as paying taxes honestly, voting in elections, showing tolerance for others, and helping people in need in both Korea and other countries, are more likely to consider environmental threats to be menacing society at large and to be more sympathetic toward the monetary contributions needed to foster environmental protection. Political interest is also a positive predictor of the dependent variable. People keen to follow urgent contemporary political issues are more likely to know that climate change is adversely affecting the environment and to exhibit pro-environmental behavior [51]. Several studies have also pointed out the positive relationships between political trust and government policies [49]. People who place high trust in political institutions are more likely to deem a given public policy trustworthy and this mental shortcut enables them to support policies such as increased taxation for environmental protection [49]. Finally, those who possess an acute sense of environmental problems in their communities are more likely to contend that the government needs to perform ameliorative measures [50]. In this way, they are more likely to support environmental taxation.

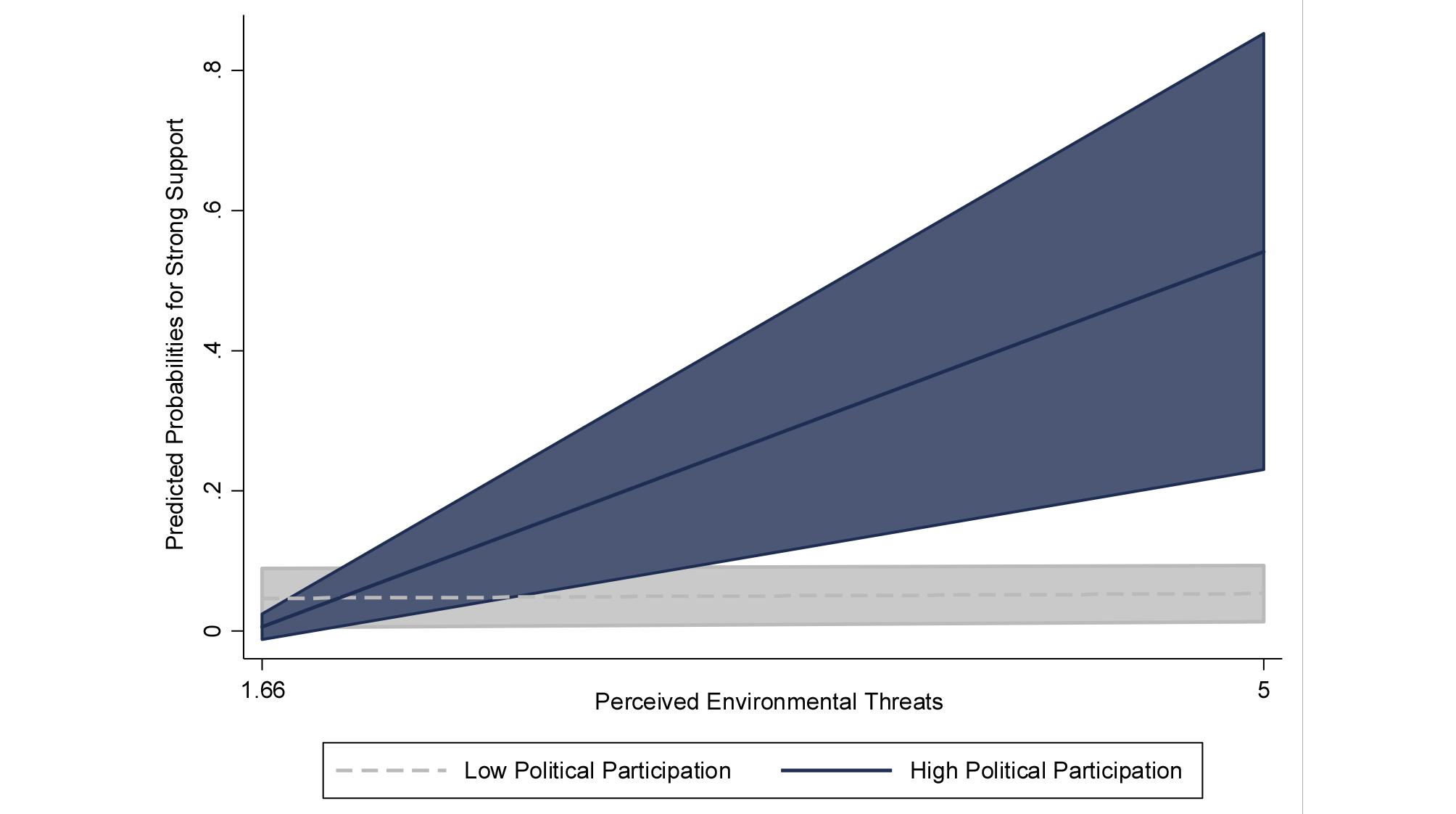

As the analysis relies on ordered probit, the predicted probabilities of each variable’s influence on the dependent variable can be estimated. Table 4 indicates such probabilities on the outcome “Very Willing” (when support for environmental taxation is at its maximum). The table shows the change in the degree of “very willing” when each variable shifts from its minimum to maximum. As seen from Table 3, a significant change is observed for several independent variables. A substantial increase in perceived environmental threats increases strong support for environmental taxation by 6.61%. Political participation is even more potent in its influence on environmental taxation; the change between its minimum and maximum leads to more than a 10% increase in strong support for environmental taxation. The largest gain for strong support of environment taxation is observed in the interaction term (political participation x perceived environmental threats). When both political participation and perceived environmental threats are placed at their minimum values, individuals’ predicted strong support for environmental taxation only hovers around 4.72%. However, when both variables are placed at their maximum values, predicted strong support makes a substantial jump from 4.72% to 54.11%, resulting in a change close to 50%. Thus, perceived environmental threats become a more powerful force on strong support of environmental taxation when contingent upon political participation. Other variables for notable, positive changes include civic mindedness, political interest, political trust, and environmental problems. In particular, individuals revealing a higher degree of civic mindedness lead to an approximately 11% gain for strong support. Political trust is also a mechanism that drives up individuals’ strong support for environmental taxation (6.01%).

Table 4. Predicted probabilities of "strong” support for environmental taxation

Figure 2 offers a visual presentation of the influence that political participation has on the relationship between perceived environmental threats and “strong” support for environmental taxation. With 95% confidence intervals, as the level of political participation increases from 1 (low) to 4 (high), the likelihood of strong support for environmental taxation steeply increases.

Conclusion and Discussion

In recent years, people have witnessed an unusual degree of environmental devastation [1]. An increased number of wildfires and storms have led to untold monetary and human sacrifices [2, 4, 5]. In these circumstances, an urgent question arises as to whether there are mechanisms to foster individuals’ support for environmental taxation and to shoulder the monetary sacrifices needed for such purposes. This study examined two such mechanisms to connect individuals to a pro-environmental behavior such as support for environmental taxation. The results confirmed the hypotheses. Perceived environmental threats led to increased support for environmental taxation. Individuals who are perceptive of environmental threats are more likely to support the monetary sacrifices necessary for environmental protection. Additionally, individuals who are active in their political life are also more likely to support environmental taxation. More importantly, the results confirmed that political participation amplifies the positive relationships between environmental threats and support for environmental taxation. The predicted probabilities for strong support revealed that the joint effects of perceived environmental threats and political participation results in powerful support for environmental taxation with a 50% increase.

The results have crucial implications for public officials, policy experts, and citizens who believe that something must be done to protect the environment. This requires significant tax support from the government via citizens. First, citizens need to be aware not only of the environmental threats posed by climate change, but also of the sources of these threats, such as pollution produced by vehicles, companies, and farming. This requires citizens to make an effort to be informed about environmental issues. It requires conscientious action to secure relevant information through printed materials as well as media outlets. Public officials who are pushing pro-environmental policies also need to make substantial efforts to cultivate citizens’ sensitivity to the environmental threats posed by climate change, as well as a diverse array of pollution sources. This can start with consistent environmental education campaigns, even for pre-school children. Children who are conscious of environmental threats are more likely to exhibit pro-environmental behavior that will help protect the environment [50]. Even for adults, environmental education can serve as a powerful tool to deter anti-environmental behavior. Running public advertising campaigns as well as devising programs to send educational materials to citizens will not only spark pro-environmental behaviors among the public, but will also foster citizens’ support for environmental taxes.

Second, the results proved that environmental causes such as support for environmental taxation demand citizens’ active participation in political life. Environmental protection is no longer an idle issue to be rescued by the government. It urgently requires active efforts on the part of citizens to become engaged with the serious environmental issues of the day. Active engagement in political issues by participating in rallies, demonstrations, and online discussion forums will strengthen the resolve of the public to solve crucial environmental issues that are increasingly threatening the sustainability of human life. Public officials also play a part here in revitalizing the political participation of citizens. This requires a mature governance system where different and even hostile opinions are tolerated and varying opinions are deliberated and negotiated. Public officials, thus, need not only to offer public forums where citizens can express their worries about environmental threats, but also to allow a climate in which hostile as well as minority opinions are tolerated and embraced. Unfortunately, citizen participation and, particularly, youth involvement are alarmingly absent from political participation [54]. Therefore, boosting citizens’ political participation in environmental causes such as support for environmental taxation will require extraordinary efforts from both public officials and citizens. When these efforts are combined to foster citizens’ perceptions of environmental threats and their active political lives, this will produce strong citizen support for pro-environmental measures. Increased citizen support for environmental taxation will eventually strengthen environmental protection and revitalize humankind’s struggle for a sustainable future.

Finally, the study possesses some shortcomings. As the study relied on one-year cross-sectional data, it was difficult to establish firm causality between the independent variables and the dependent variable. Second, a test was conducted to examine a common method bias, but self-reported data relying on a single dataset presents substantial threats to the validity of the study. Thus, the results in this study will require further verification in future studies by using diverse datasets collected in different time periods.